amazon flex quarterly taxes

A quarterly study that explores changes in consumer behavior. The IRS only requires Amazon Flex to send drivers the 1099 form if you made over 600 the previous year.

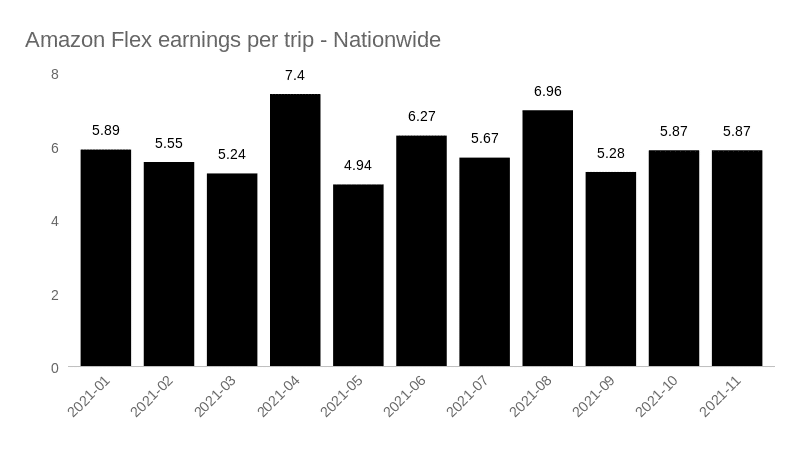

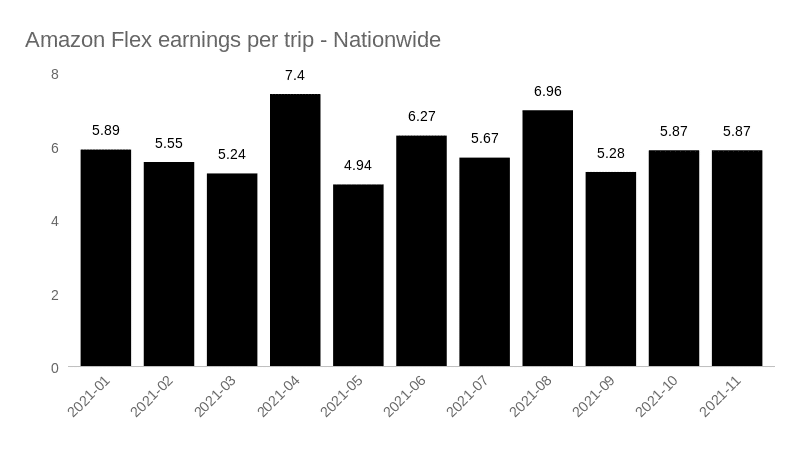

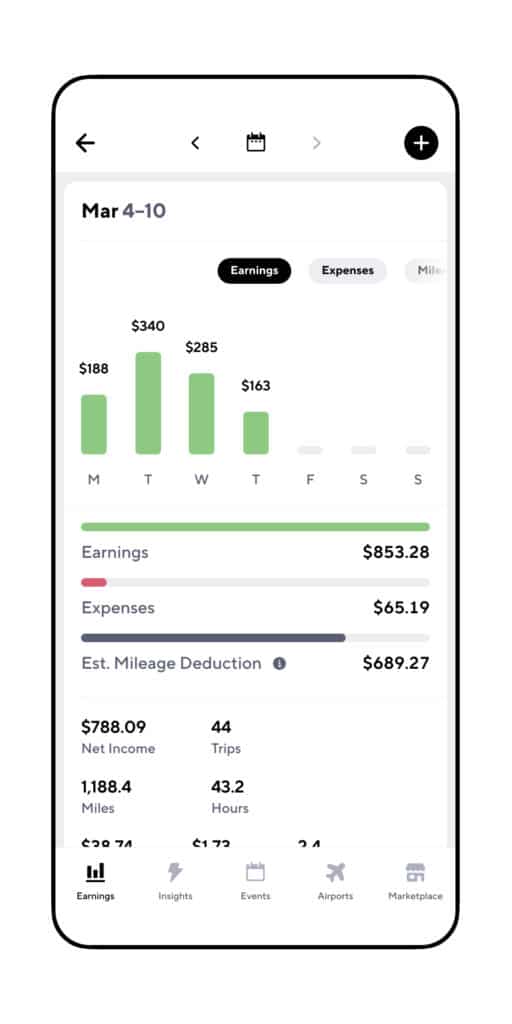

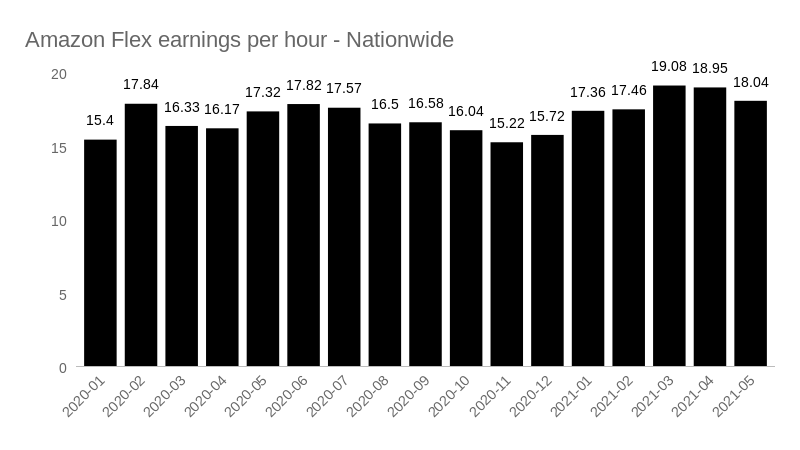

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

Gig Economy Masters Course.

. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and. 90 of the tax you owe for the current year. In this guide well go over how file and maximize your tax savings at the end of the year.

You only need to do quarterly taxes if youre going to be above 1000 owed on your yearly return. Contact the Amazon personal department and request a copy of the 2019 W-2. How To Pay Taxes For Amazon Flex R Amazonflexdrivers Most small time investors are allowed to file their taxes annually on April 15th.

For a summary of multiple order details use the Date Range Report Order Report orders you fulfill or Fulfillment Report orders fulfilled by Amazon. Filing taxes as an Amazon seller can be a mystery. One way you can do this is to drive a fuel-efficient vehicle.

You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. Amazon Flex pays out twice weekly on Tuesdays and Fridays Quarterly Taxes After year 1 as an independent contractor you are expected to pay quarterly estimated taxes. Because working for Amazon Flex makes you an independent contractor youll be responsible for withholding money for your taxes.

Amazon income taxes for the quarter ending December 31 2021 were 0612B a 813 increase year-over-year. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year.

Increase Your Earnings. If you are an Amazon Flex 1099 driver pay close attention to this tax guide. Knowing your tax write offs can be a good way to keep that income in your pocket.

So if you want to make a decent income as an Amazon Flex driver you have to be smart about gas. Stay tuned because in this article well walk you through the difference between consultant taxes to employees quarterly taxes self-employment taxes and tax deductions. Driving for Amazon flex can be a good way to earn supplemental income.

State of the Amazon Seller Annual insights from real Amazon sellers. Amazon Flex - US. To help you prepare we compiled information about deadlines deductions forms and sales tax reporting.

Most drivers earn 18-25 an hour. Amazon Flex quartly tax payments. If youre looking for a place to discuss DSP topics head over to ramazondspdrivers.

Amazon Flex does not take out taxes. For individual order details use the Order Details or Transaction View page. You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply.

Youll owe self-employment quarterly and income taxes for the year. This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits.

With only Flex amount stated youll be well below that number. Youll need to submit a tax return online declaring your income and expenses once a year by 31 January as well as paying tax twice a year by 31 January and 31 July. Use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you closer to your goals.

Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. If you can estimate your earnings and pay your taxes quarterly and then you wont be stuck with a gigantic bill at tax time. You may also need to.

Need to file your 1099 consultant taxes. You only need to do quarterly taxes if youre going to be above 1000 owed on your yearly return. Amazon Flex Legal Business Name.

Income taxes can be defined as the total amount of income tax expense for the given period. A Toyota Prius for example usually gets about 50 miles to the gallon whereas a Jeep Cherokee gets about 19 miles to the gallon. You expect your withholding and credits to be less than the smaller of.

The Safe Harbor rule helps new business owners estimate how much taxes they will need to pay quarterly to avoid a penalty. Tax calculation details such as the tax rate and taxing jurisdiction are only available in the sales tax report. If you have a W-2 job and do Amazon Flex for extra money you can increase your withholding at your main job instead of paying quarterly taxes.

100 of the tax you owed for the previous tax year. However in the event that you dont receive the form and you made over 600 you will still have to report your income taxes. Therefore expect to see a spike in your gas bill each.

Now if like many established businesses you will owe a tax bill at the end of the year then you are likely on the hook to. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on. Amazon annualquarterly income taxes history and growth rate from 2010 to 2021.

How do I get my w2s from Amazon. If you dont have other tax withholding that covers your tax liability you will need to make quarterly tax payments. If you have a lot more 1099 side work you can add to your estimated quarterly due.

Just claim the 1099 next year. No one wants to think about paying taxes but as an independent contractor driving for Amazon Flex youll have to pay your own.

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How Amazon Build One Day Shipping Digital Laoban

What It S Really Like To Gig For Amazon Flex

How Amazon Build One Day Shipping Digital Laoban

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To File Amazon Flex 1099 Taxes The Easy Way

Amazon Flex Drivers In Nsw Win Minimum Hourly Pay Rate Australia News The Guardian

Amazon Flex Comes Under Fire For Poor Working Conditions Inside Retail

Amazon Flex Filing Your Taxes Youtube

How Much Do Amazon Flex Drivers Make Gridwise

Amazon Flex Drivers Ask Amazon To Help With High Gas Costs Protocol

How Much Do Amazon Flex Drivers Make Gridwise

How Amazon Flex Drivers Get Deactivated What Is Standing Reliability Rating System Courier Hacker

How To Do Taxes For Amazon Flex Youtube